Website: bitrue.com

About company:

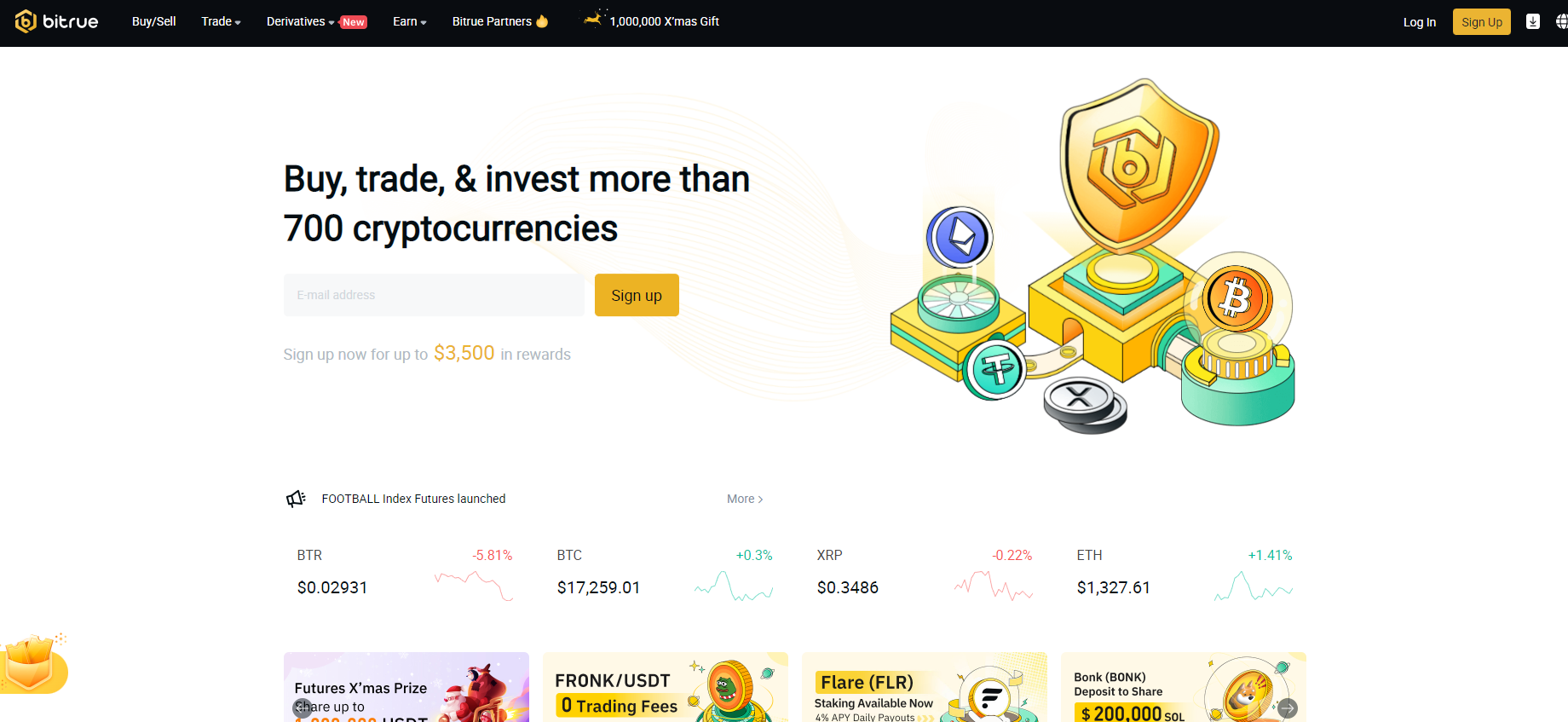

Bitrue is a cryptocurrency exchange that launched in July 2017. The trading floor was registered in Canada, but over time the company opened additional offices in the United States and Singapore. The US and Southeast Asian markets are a priority for bitrue.com, but traders from Russia can also work on it. We bring to your attention a detailed review of the Bitrue cryptocurrency exchange, consider the capabilities of this exchange and customer reviews about the company. Site review bitrue.com Since the cryptocurrency exchange is aimed at users from America and Southeast Asia, there is no Russian-language interface on the site. Traders who know English well will be able to work on the stock exchange. The main page of Bitrue contains an overview of the latest news and company announcements. In particular, in December, the platform introduced the possibility of borrowing, added 30 new trading pairs with Ripple, and also announced a drawing of 240,000 XRP.